Johnson Financial Group benefits team suggests ways to prepare for unexpected health insurance cost increases

MILWAUKEE, WI, February 07, 2023 /24-7PressRelease/ — Employers could be shocked to discover that health insurance costs will grow as employees who took advantage of state health insurance programs, which were expanded due to the pandemic, will no longer quality for those benefits after April 1st. Johnson Financial Group’s employee benefits planning team has cautioned that employees and their dependents who will lose their pandemic related extended coverage will have the ability to, and probably will, return to their employer-sponsored health plans.

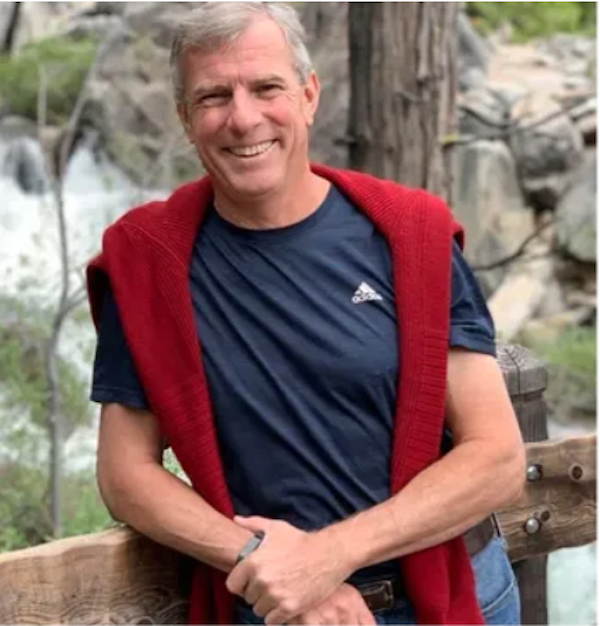

Recently, JFG’s Hugh Devlyn and Thom Mangan wrote an article detailing how Wisconsin and some other states broadened access to state-sponsored health insurance schemes, thanks to federal legislation necessitating that Medicaid-backed programs keep workers enrolled throughout the pandemic. However, new omnibus legislation is about to take away this extended eligibility. Therefore, states must act now to ensure qualified individuals remain insured. In eleven states, including Wisconsin, the Medicaid qualification is not being extended, meaning many individuals already enrolled in the programs will no longer have access to health insurance. It is estimated that between 5 and 14 million workers will miss out on Medicaid coverage, leading to a significant increase in health insurance expense for employers.

What this means for employers

As workers became eligible for these federally funded programs, they waived employer-sponsored coverage. These same employees may look for continued coverage once their eligibility expires. JFG’s Devlyn and Mangan suggest this could increase premiums by up to $10,000 in employer costs for each employee who joins or returns to employer-sponsored plans.

“Many employers will be caught flat footed with unanticipated health insurance costs. But they can take steps to defray these costs of added participation in their health plans,” said Mangan.

Steps employers can take to prepare

Mangan suggests employers should evaluate their company’s situation. “Employers should do a cost/risk analysis with data from their most recent open enrollment to determine how many of their employees waive coverage and are covered by state programs.” As a point of reference, the typical Employer with a high concentration of hourly workers saw on average 3% to 5% of their employees waive group health insurance as they were covered by the expanded Medicaid program.

Next, employers should determine the financial impact by calculating the cost of adding those employees to the most affordable health insurance option. Communication with employees is crucial so they know about upcoming coverage changes and are informed of employer sponsored alternatives.

Most importantly, Mangan suggests employers stay current on news and regulations regarding this change. “It is important to stay on top of the latest rules to provide the best coverage possible for your employees.”

For more information, visit Johnson Financial Group’s Employee Benefits page.

About Johnson Financial Group

Johnson Financial Group is a privately owned financial services company offering banking, wealth and insurance solutions through its subsidiaries, Johnson Bank, Johnson Wealth, and Johnson Insurance Services. For 50 years, we have put our clients first by serving as a trusted advisor, with engaged family ownership, strong values and committed associates. Firmly rooted in our community, ensuring it is a better place by volunteering and providing support where needed. For more information visit www.johnsonfinancialgroup.com.

—

For the original version of this press release, please visit 24-7PressRelease.com here